As shops, offices, and restaurants in Peterborough adapt their business models and work to carefully reopen, we are reconciling with new economic realities.

COVID-19 has illuminated the precarious nature of our communities in many ways, threatening a large number of businesses and sectors. Many in our vibrant local business community are likely to require financial assistance over the coming months and beyond in an effort to recoup losses and re-build.

The time is now to consider how we might move forward by developing more sustainable and resilient economies and communities.

In response to the pandemic, the provincial and federal governments have introduced a number of funding programs designed to support businesses. While all levels of government work to develop post-pandemic economic recovery plans, there is a unique opportunity for change towards a healthier and more resilient economic and environmental future.

Stimulus spending is spending as a result of government policy that is introduced to help stimulate a struggling economy. In recent months, the provincial and federal governments have introduced stimulus packages to facilitate recovery from the pandemic.

Stimulus spending has the potential to boost economic prosperity and spark employment in Peterborough. Choosing to fund support for climate action initiatives like deep energy retrofits and renewable energy installation — as well as training in sustainable building and trades professions — can all help achieve a green recovery.

A strategic and informed implementation of stimulus spending could help solve two problems at once. A green recovery could simultaneously give us the chance to recover from the pandemic and also limit the destabilizing outcomes of the climate crisis.

Recovery stimulus funds in the past, like the many programs delivered during the recession of 2008, allocated comparatively little to climate initiatives. Likewise, many previous stimulus programs in nations around the world upheld investments in sectors with high greenhouse gas emissions and required no climate action or green innovation.

In contrast, COVID-19 sees national governments in Europe and Asia considering recovery and stimulus strategies that increase economic and environmental resilience by supporting companies who upgrade facilities and switch to low-carbon business practices.

In June 2020, Germany invested 130 million euros (roughly $220 million CAD) in its recovery, with 30 per cent earmarked exclusively for green stimulus projects that will cut greenhouse gas emissions. The European Union has proposed that 25 per cent, or more than $300 billion CAD, of their stimulus package be dedicated to climate-friendly measures like building renovations, clean energy technologies, low-carbon vehicles, and sustainable land use.

In Canada, stimulus spending needs to focus our efforts on greening existing industries and creating new industries. The federal government has already begun to increase funding in green jobs, which indicates some commitment to sustainability.

Additional COVID-19 response funding was announced last month for Natural Resources Canada’s Science and Technology Internship Program, which subsidizes green jobs within the natural resources sector through the Government of Canada’s Youth Employment and Skills Strategy.These internships are available to businesses of all sizes and will be welcome relief to many companies and students alike.

For Peterborough, funding programs tailored to meet the needs of small and medium-sized enterprises (SMEs) are vital. Many past climate-mitigation and adaptation funding programs emphasized large-scale industrial or commercial retrofits, while few emphasized the importance of engaging smaller businesses. SMEs account for over 90 per cent of all businesses in the region, while 42 per cent of all businesses have less than five employees.

Many of Peterborough’s SMEs desire to take action on climate change but often lack the time, resources, and capital to put their values into practice. Even with federal incentives designed to support businesses in retrofits and other climate action initiatives, the capacity of SMEs to implement these changes often remains a barrier.

Fortunately, over the next year the Peterborough region will directly benefit from the development of Green Economy Peterborough. Like other Green Economy Hubs across Canada, Green Economy Peterborough is a community-based program for businesses of all sectors that provides the tools, resources, peer network, and long-term support that SMEs need to successfully build sustainability into their operations.

This local Green Economy Hub will be part of a national network of hubs supported by Green Economy Canada. Businesses across the network have shown that improved energy efficiency and a culture of sustainability can transform a small business’s financial outlook and competitiveness. Significant investments in building improvements can permanently lower operational and maintenance costs. This leaves room to reinvest in jobs and growth, while also keeping more dollars circulating within Peterborough’s local economy.

More than 300 businesses are participating across the national network, and together they have reduced their collective greenhouse gas emissions by over 200,000 tonnes as of December 2018. Through their participation in a local Green Economy Hub, these businesses are supported to develop climate action plans and public reduction targets that are designed to reflect their unique needs and aspirations.

With corporate climate action plans and targets in place, these SMEs are in a better position to successfully secure government or private funding to complete energy efficiency retrofits or other climate action projects. Green Economy Peterborough will provide critical support to local businesses, increasing their readiness to take strategic climate action and helping to ensure that they are in a strong position to benefit from future climate funding or green stimulus programs.

VIDEO: Green Economy Canada: It’s Possible – 2018

A safer, healthier, green recovery could help our business community make the changes we need to meet our climate targets and help avoid irreversible climate change. There is no doubt that small businesses in our regional economy need job support and a boost in capital. Investments in green stimulus deliver both an immediate and long-term return that benefits businesses and the broader community. Supporting local SMEs in cutting costs, growing sales, and improving their resiliency helps us build back better.

With sustainability in mind, stimulus funding can become the catalyst Peterborough needs to recover today and build a stronger and cleaner economy for the future.

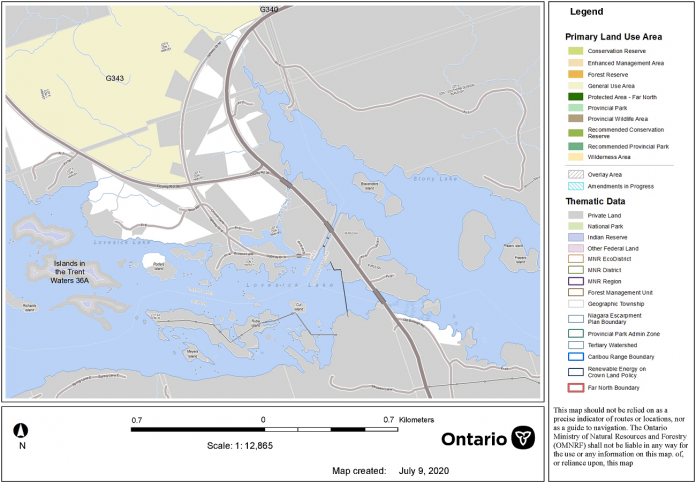

To learn more about Green Economy Peterborough, visit greenup.on.ca/green-economy-peterborough or contact Natalie Stephenson, Green Economy Peterborough Hub Coordinator at GreenUP, at 705-745-3238 or natalie.stephenson@greenup.on.ca.